Questions? (866) 550-6932

Group Insurance is Never Enough Life Insurance

If you have access to group life insurance coverage, consider yourself lucky as few workers have a group benefit plan.

However, one should never rely on their group life insurance, group disability insurance or group accidental death and dismemberment coverage as the core life insurance strategy. Relying on group is the equivalent of hoping a band-aid will fix a broken arm.

When reviewing your group life insurance booklet, you will notice that the employee will always be limited to a set amount of life insurance coverage. Such as:

- 1 x salary

- 2 x salary

- Unit purchase amounts in discretionary $10,000 increments with a ceiling limit of $300,000 - $500,000

The problem with group life insurance is that it’s simply never enough life insurance coverage. Let’s prove it.

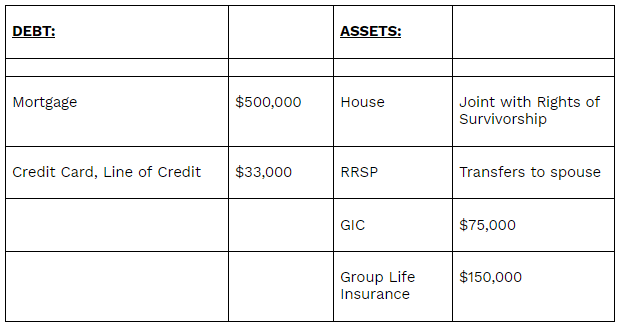

An individual earns about $90,000 after tax and deductions. They have a house and some RRSPs. These assets will transfer correctly as the house is jointly owned and the RRSP has the correct beneficiary designation. These assets are therefore neither sold nor liquidated to clear debt or pay income tax and will become solely owned by the surviving spouse. The spouse works earning a solid salary and has some retirement savings.

Together they have some debt from a recent home renovation on the line of credit and some credit card debt totaling $33,000.

There are 2 minor children in this scenario, age 7 and age 3. In 20 years, the eldest will have graduated post-secondary, and the younger will be finishing. The cost today is about $20,000 a year per child for a 4-year degree (tuition, books, food, technology, rent, parking pass / public transportation, fun spending).

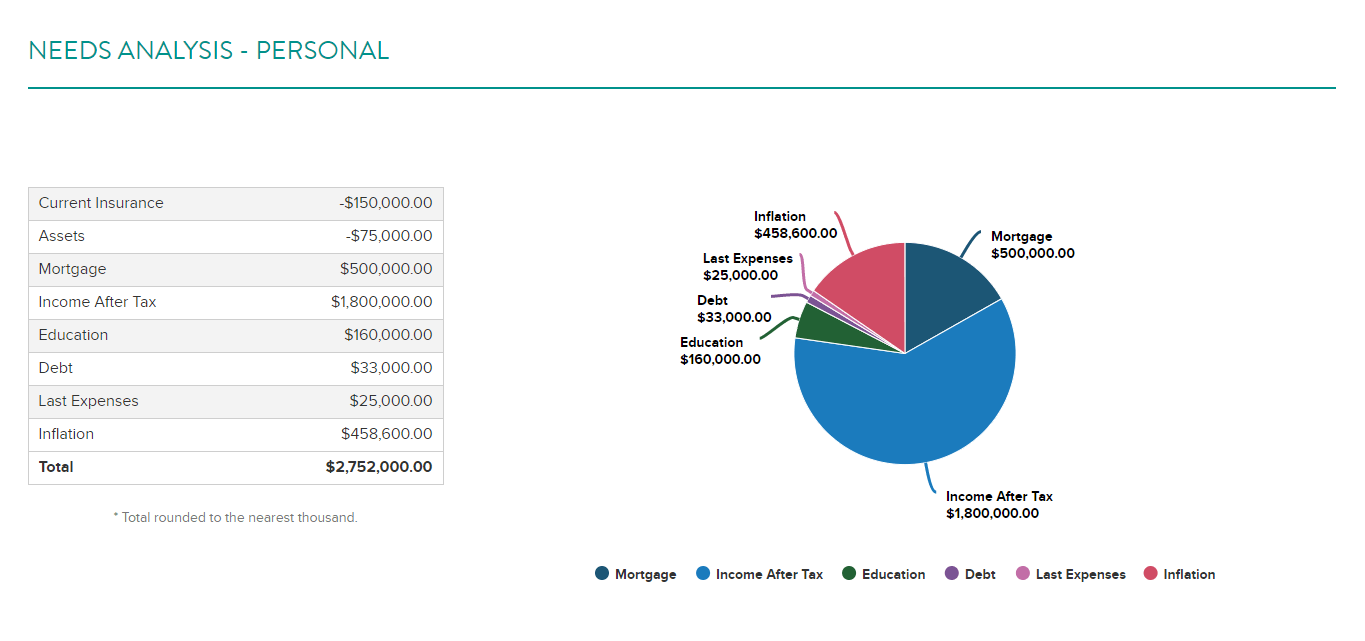

A modest $25,000 is allocated for last expenses, and a GIC will be liquidated on death.

The individual has group life insurance coverage of $150,000.

Here’s a snapshot:

$150,000 barely makes a dent in the mortgage, let alone provide enough cash to cover other unexpected expenses (surprise tax bills, grief counsellors etc.).

This family is not super wealthy. They’re kind of average. Does it sound familiar?

Inflation is 1% and the calculation is stretched over 20 years to get the youngest to their final year of college / university.

My simple little scenario generated a monstrous life insurance shortfall. The person has $150,000 in life insurance coverage. They need over $2.7 million.

Even if you do not feel that you “need” that much, the need is clearly bigger than a measly $150,000.

Perhaps you go with an amount that will pay off the mortgage, clear the debts and funeral expenses and provide a bit left over to replace your income for a few years.

We work with your budget. Rarely can people afford what they need, after all there are the expenses related to hockey, dance, a gym membership, wine club, groceries, and the babysitter for date nights (when you can do that again).

Please don’t forget the importance of your human capital. The $1.8 million is what that person could take home in after tax income to their family over 20 years. Maybe it’s more, maybe it’s less, but the number will be large.

We want to protect that ability to earn an income. Therefore, I will always recommend that we work some disability insurance into your overall life insurance strategy.

Bear in mind that if your circumstances change such as you leave your current employment, that little bit of group life insurance will go “poof”. Always own your destiny.

Own your own life insurance and get the amount of coverage you need to properly protect your family.

Taivi Tayler has been in the financial services industry for over 20 years. She specializes in estate planning and risk management solutions that are integrated into comprehensive wealth management concepts. Tax minimization is at the forefront of every client relationship while developing suitable retirement and financial planning strategies. Her primary focus is client financial literacy and she uses simple illustrations to teach retirees, business owners and high-income earners how to recognize current and future financial challenges while demonstrating that they have choice in how to better manage their wealth.

Learn more about how Taivi can make life's biggest financial decisions easy to understand at https://www.taylerinsurance.com/about.

Let’s Talk

- Do you want to reduce your tax burden?

- Manage cash flow?

- Protect your paycheque?

- Secure your retirement?

- Help with succession planning?

Contact us today; we are here to help.

Contact Us

We will get back to you as soon as possible

Please try again later